César Ramos | Global IFRS 9 & Hedging Expert

Stop P&L Volatility. Start IFRS 9 Compliance.

The IFRS 9 Hedging Quick Start Toolkit is the fastest way for SMEs to implement audit-proof Hedge Accounting—without hiring a Treasurer.

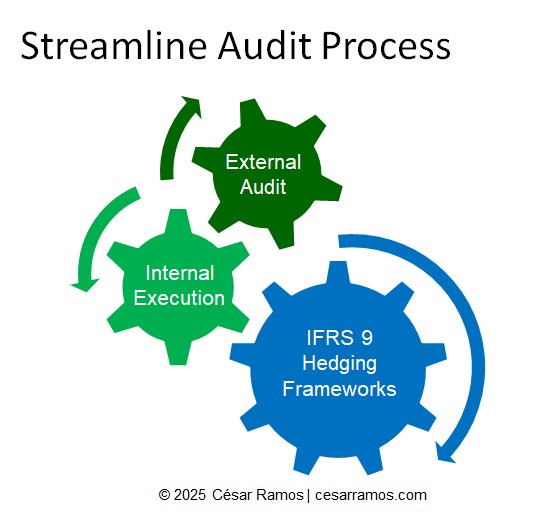

Figure 1: Streamline Audit Process

Stop the friction between your team and the auditors. Our Framework streamlines the process.

View the Quick Start Toolkit & Pricing

Need custom implementation? Book a Remote Strategy Session.

Your Business Solves Three Core Problems Instantly:

1. P&L Stabilization

Our Spot-to-Spot methodology prevents derivatives’ Mark-to-Market volatility from destroying your reported profit and loss (P&L) results.

2. Audit-Proof Compliance

Go from zero documentation to full IFRS 9 compliance with our pre-built Designation Memos and Hedge Effectiveness Checklists, validated by an experienced Auditor.

3. FX Risk Management (Quick Start)

Implement a robust, professional hedging function in weeks, not months. The Toolkit acts as your outsourced Treasury procedure manual and calculation engine.

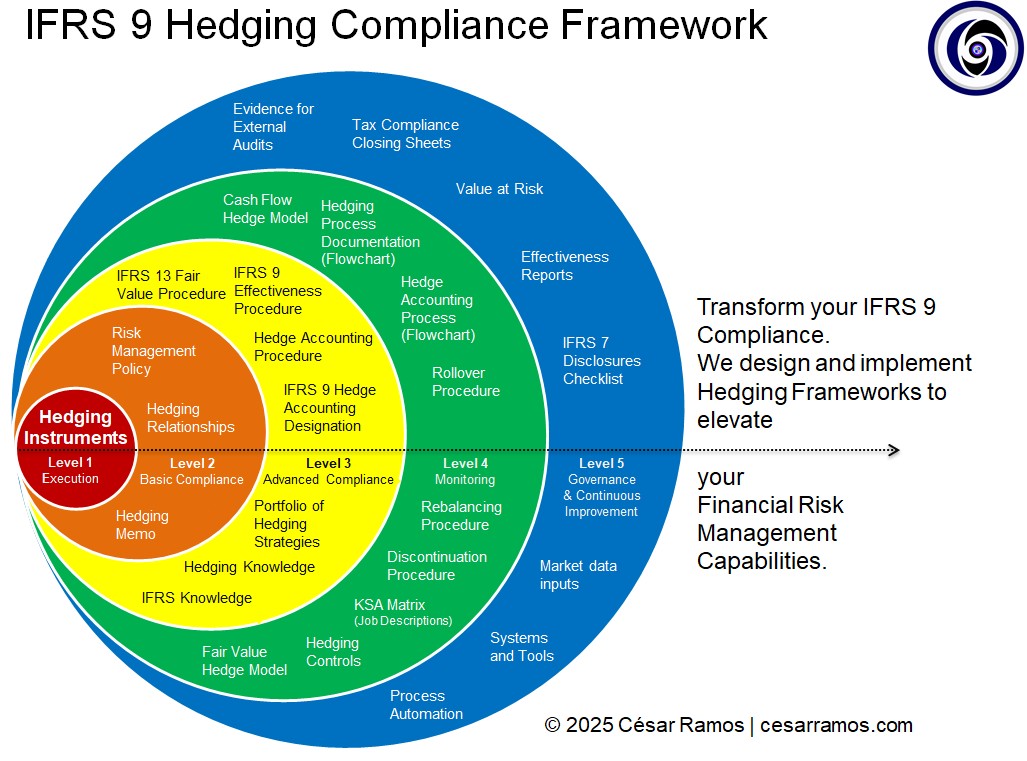

Our Proprietary IFRS 9 Compliance & Maturity Framework

The Toolkit covers Levels 1 to 3 and partially Level 4, providing all the necessary models and documentation for Full Procedural Compliance.

Meet Your Expert: César Ramos

I empower growing businesses to quickly implement robust risk management, mitigate FX risk, and stabilize P&L results. I deliver audit-proof compliance using the IFRS 9 Spot-to-Spot method.